A net-zero leader on how investment and innovation might save us

BY SIGNE BENN HANSEN

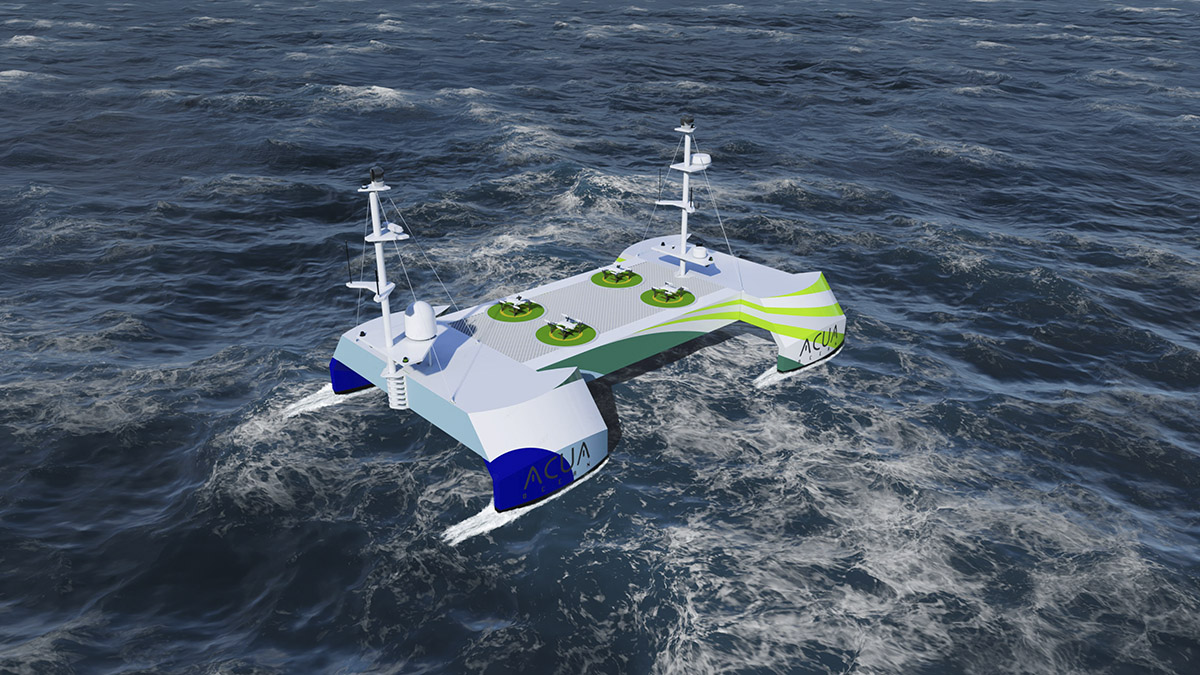

Photo: Sunswap

Last year, Beverley Gower-Jones, the founder of the climate venture capital fund Clean Growth Fund, and the cleantech consultancy, Carbon Limiting Technologies, was appointed to the UK Government’s Net Zero Innovation Board. This year, King Charles bestowed her an Officer of the Most Excellent Order of the British Empire (OBE), for services to net-zero innovation. Discover Cleantech asks the climate leader whether investment and innovation can actually save the planet.

For two decades, Gower-Jones has advised major corporates, UK and overseas governments, SMEs and cleantech start-ups on addressing the challenges of climate change. Through her cleantech consultancy, Carbon Limiting Technologies, she has helped hundreds of cleantech entrepreneurs to commercialise and grow their business. ”We make sure that the technology is based on the laws of physics – that it’s real tech,” says Gower-Jones matter-of-factly when asked how she discerns between the myriads of cleantech ideas and innovations trying to get on the net-zero train. Among the many other factors the founder and managing partner of the Clean Growth Fund looks at, is what the total carbon saving would be if the technology was to be commercialised over five to ten years. In short: “does it move the needle”.

But these are just two among a host of structural, human and market factors that Gower-Jones examines. Because, while being innovative and disruptive is essential, more pragmatic factors, such as whether the management team comes off as “credible, ethical people that will be able to pivot when things change – because nothing ever goes the way we want it to all the time”, are also critical. So too is the customer and client interest, the level of market engagement achieved, and the projected business model – the mechanism by which the entrepreneurs plan to get the technology to market and make revenue. Finally, the fund carries out an assessment report that looks at the potential greenhouse gas reduction from the related innovation, analysing what the cost per tonne of saved carbon would be. “There is no point in having something that saves carbon but is too expensive to be affordable,” stresses Gower-Jones.

Two decades at the forefront of decarbonisation

Despite her impressive and somewhat intimidating status in the world of cleantech, Gower-Jones’ path into the net-zero transformation was not unlike that of many a grassroot activist. An avid Scuba diver, she observed and regretted the degradation of corals; upon discussing the subject with her colleagues at QinetiQ, her workplace at the time, she discovered how deeply she actually felt about the topic. “I remember arguing that we would be remembered not as the age of communication, but as the age of pollution, and I thought – if I feel that deeply, I should do something about it,” she says.

With an educational background in geology and an in-depth knowledge of technology commercialisation – for 20 years, Gower-Jones had worked for Shell, where she co-founded Shell Technology Ventures of which she was vice president – Gower-Jones knew she had a skillset vital to the net-zero transition. So, she left her position at QinetiQ to pursue her passion for the planet. “I could see that the energy transition was going to be a huge piece of this and that we needed new technology to achieve that transition, and I wanted to play my part – to make sure we do everything we can to get to net zero as soon as possible,” she says.

Soon after, Gower-Jones set up Carbon Limiting Technologies, and her work with cleantech entrepreneurs and SMEs quickly made her realise the scale of the funding gap. However, getting people to appreciate and understand the huge investment gap in the early development of technologies was a challenge. “One of the barriers to tech commercialisation is finance. It took ten years to set up the Clean Growth Fund, to get people to appreciate and understand the huge gap and equally huge financial opportunity in early development, but in the end, we raised 101 million pounds [government and private funds] so now we can begin to invest in that opportunity and deliver commercial returns to our shareholders.”

Indeed, says Gower-Jones, the response she meets today is a world away from what she experienced two decades ago. “Today, climate change is talked about in all FTSE board rooms, whereas when I started, no one knew or talked about it. In 2006, the conversation was – is it a real thing? Now, the conversation is – oh my god it is real, what are we going to do about it? But often managers don’t know what to do or where to start, so we can look at how to help, what’s the low-hanging fruit, where should we start and how do we create a roadmap to net zero to futureproof our company for the next century.”

The Clean Growth Fund has invested in measurable.energy, a company that designs and manufactures smart, machine learning enabled power sockets that reduce the energy costs of commercial buildings by more than 20 per cent. Photo: measurable.energy

Where will the next big thing happen?

When asked in which sector she sees the biggest potential for disruptive developments and investment opportunities, Gower-Jones does not hesitate to say that it is everywhere. “Every sector you look at offers such enormous opportunities. In the energy sector, it’s all about long-term energy storage and flexibility, where the demand side and supply side can trade their need for electricity. For someone who can crack the challenge of that or long-term storage, there are massive opportunities. The same goes for the building sector if you can solve the issue of domestic heating. Heat pumps are good for about 50 per cent of our housing stock, but not the rest, so we need innovations for proper insulation and other forms of electric heating,” she stresses.

She goes on to list the need for innovations that can assist the industrial sector to utilise the enormous amount of waste heat currently produced. Of course, carbon capture is another critical technology, she stresses. But there are so many more sectors mushrooming and sprouting with incredible speed: the micro-mobility sector, batteries and solar for distributed generation, as well as hydrogen-driven propulsion for planes, ammonia for ships, and combinations of it all. “You cannot just say ‘this’ is an interesting area – there are fantastic opportunities in and across all these sectors,” she stresses.

How to get the big players to drive the change

While the cleantech market is literally boiling with innovation and initiative, and in turn opportunities for early-stage investors, the big established players are often perceived to be dragging their feet and even resisting the change. This is, according to Gower-Jones, predictable but unfortunate. “It is the newcomers that bring in disruptive change; it is very difficult for industry incumbents to make change and transition, because they have too many vested interests – employees are worried about their jobs, and the business needs to keep returning shareholders’ dividend,” she says. “This means the old ships are turning slowly to point in the right direction, while small and nimble new players lead the way.”

Just like big corporations are often accused of slowing down the transition, governments are commonly suspected of using words rather than actions to quieten environmental concerns. When asked what she thinks could help this situation, Gower-Jones points to accountability as one of the biggest issues.

“The UK government set up the Committee on Climate Change as an independent body to hold the government to account to their goals – the goals have been held so far; the prediction is that they might not meet the next one, but it has been a successful monitoring structure. I wish we could export that to every other country. Promising net-zero contributions is fine, but we have to deliver, and having someone holding us to account helps.”

The snowball is rolling

When asked about her OBE, which was one of many awarded for environmental and net-zero services at the 2023 New Year’s Honours, Gower-Jones explains that she believes she received it as a recognition of her work to support hundreds of cleantech SMES commercialise. As such, it is symbolic of the increasing number of awards and organisations recognising and supporting innovators developing low-carbon solutions. “I think, since 2019, the tide has turned in terms of the public; the heightened awareness and the understanding of the dire situation the planet is in has gone up exponentially,” she says. “What I see now is a wave of other funds commercialising in this space, focusing on low-carbon cleantech. I’ve had calls from many organisations from Europe and the UK, saying – we want to set up a cleantech fund, and it’s that kind of private money we need to commercialise the solutions in this space, so I consider that a major achievement.”

However, while innovation and investment may do a lot to turn the ship, governmental support and structures are necessary to help speed up the process. Among the tools needed are, according to Gower-Jones, financing packages to help customers buy low carbon-solutions, which often come with higher capital costs and lower operational costs, assisted “no regret trials” of new technologies, and policies “adapted to the world we live in”. There is, however, one critical problem that needs to be solved first and foremost. “When talking about GDP, there is no way to factor, for instance, biodiversity, or anything like that. How do you put a value on a bee? And yet, without pollination, humans will cease to exist, and I think that is a problem. She goes on to explain that it’s not about putting a price on nature. Humans completely rely on nature, and without nature there is no planet; so it is about changing the very system in which we operate. We cannot get a sensible price on carbon even though we have been talking about that for over ten years – it’s a fundamental issue,” she says, adding: “We still have policies that have been set up for a world where gas was considered clean and electricity dirty. With renewables generating our electricity, that has changed completely, but the incentives and structures, whether in the building or power sectors, are constructed for the world that was, not the world that we are moving to. There is a lot of regulative policy work that needs to be redesigned and put in place to enable the transition.”

Still, after two decades in cleantech development, Gower-Jones, is confident and optimistic that we have reached the turning point, that right now decarbonisation is ”right at the top of the agenda, and the snowball is running down the hill, faster and faster.”

Among the cleantech companies the Clean Growth Fund has invested in, is Indra, which has developed the Smart Pro, an EV charger which automatically optimises for the cleanest, cheapest electricity and enables vehicle-to-grid discharge. Photo: Indra

The Clean Growth Fund

The Clean Growth Fund is a commercially run venture capital fund, which aims to speed up the deployment of innovative clean technologies that reduce greenhouse gas emissions, by making direct investments in companies seeking to commercialise promising technologies. The Fund’s focus is on commercial returns and UK-based innovations that demonstrate clear reductions in greenhouse gases. The Fund’s current portfolio of investments is available from the Clean Growth Fund website.

In March 2022, the Clean Growth Fund announced the final fund size of £101 million, with seven private sector investors backing the Fund, alongside BEIS.

Beverley Gower-Jones standing with her portfolio founders during one of the Clean Growth Fund’s regular Portfolio Days. Photo: Clean Growth Fund

Carbon Limiting Technologies

Since its foundation in 2006, CLT has worked with hundreds of cleantech entrepreneurs to help them commercialise low carbon technologies.

CLT is committed to ensuring innovations stack up commercially, technically, financially and socially. By delivering public sector programmes and incubation support, and working with companies to innovate and internationalise, the company aims to accelerate the transition to a low carbon, sustainable economy.

Furthermore, the consultancy has supported national and regional governments to create the policy conditions that support clean growth, and is increasingly targeting green finance as the third pillar to enable rapid scale-up of transformative solutions.

The Clean Growth Fund The Clean Growth Fund is a commercially run venture capital fund, which aims to speed up the deployment of innovative clean technologies that reduce greenhouse gas emissions, by making direct investments in companies seeking to commercialise promising technologies. The Fund’s focus is on commercial returns and UK-based innovations that demonstrate clear reductions in greenhouse gases. The Fund’s current portfolio of investments is available from the Clean Growth Fund website. In March 2022, the Clean Growth Fund announced the final fund size of £101 million, with seven private sector investors backing the Fund, alongside BEIS. Carbon Limiting Technologies Since its foundation in 2006, CLT has worked with hundreds of cleantech entrepreneurs to help them commercialise low carbon technologies. CLT is committed to ensuring innovations stack up commercially, technically, financially and socially. By delivering public sector programmes and incubation support, and working with companies to innovate and internationalise, the company aims to accelerate the transition to a low carbon, sustainable economy. Furthermore, the consultancy has supported national and regional governments to create the policy conditions that support clean growth, and is increasingly targeting green finance as the third pillar to enable rapid scale-up of transformative solutions.

Subscribe to Our Newsletter

Receive our monthly newsletter by email