Electric vehicles in China and Europe – not a race against each other, but toward their own climate targets

BY HUI HE

Hui He, China regional director for the International Council on Clean Transportation, explores the similarities and differences of the Chinese and European EV markets.

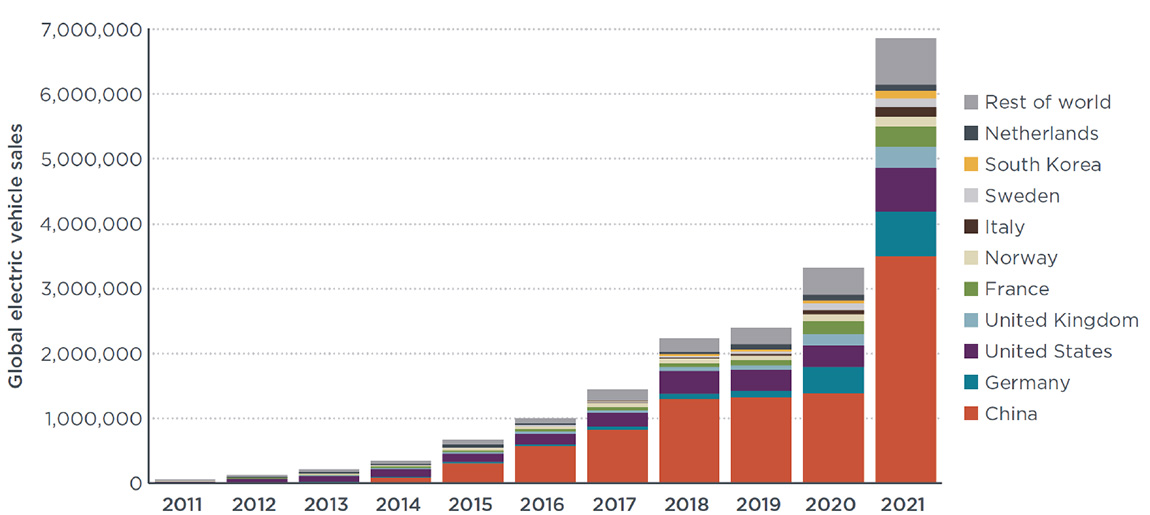

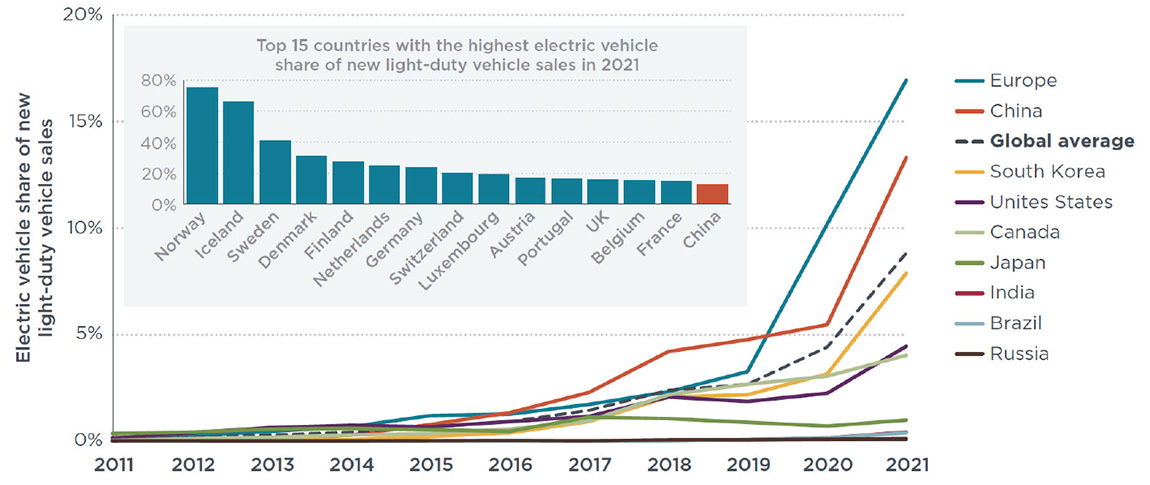

Both China and Europe can proudly claim leadership in the global electric vehicle market, in two different ways. Last year, China sold the most electric vehicles in the world, nearly 3.5 million, and that’s more than the sum of the rest of the world combined (Figure 1). Europe, however, led by a large margin in terms of electric vehicle (Electric vehicles include battery electric vehicles and plug-in hybrid vehicles) market penetration: 19 per cent of new cars sold in Europe were electric, three percentage points higher than the value in China and double the world’s average (Figure 2).

Figure 1. Annual electric vehicle sales globally by market from 2011 to 2021. (Source: ICCT: https://theicct. org/publication/global-ev-update-2021-jun22/)

Even based on this obvious data, it is still not easy or straightforward to say which region is ‘winning the race’, because the two regions are not simply racing against each other, but their own decarbonisation targets.

Discover Cleantech

Theme/subject: EV/China

Date: 27/07/2022

Writer: Hui He

Words: 1000

I have left the graphs in the document as they need to be placed specifically in the text as they are here. I also hope to get an image of Hui He to go with the caption below, but if not possible, please present the caption as a small info box or similar.

Caption (or info box): Hui He, China regional director for the International Council on Clean Transportation (ICCT), joined the ICCT as a policy analyst in 2007 and took on oversight of the China programme in 2014. She has a master’s degree in public administration from the University of Texas, and dual bachelor’s degrees in international relations and economics from Peking University, China.

Suggestions for additional images.

https://www.dreamstime.com/stock-photo-beijing-china-cbd-cityscape-image51760529

https://www.dreamstime.com/stock-photo-beijing-china-financial-district-skyline-city-image48999066

Caption: Though China sold nearly 3.5 million electric vehicles last year, market penetration is significantly lower than in Europe.

https://www.dreamstime.com/visit-byd-bus-manufacturing-factory-china-march-xi-shaanxi-province-group-fans-visited-s-plant-closely-watched-image142175795

https://www.dreamstime.com/editorial-photography-hong-kong-china-january-electric-smart-vehicle-charging-station-located-hong-kong-city-image95593487

https://www.dreamstime.com/stock-photo-charging-pile-parking-lot-beijing-china-image91828707

Electric vehicles in China and Europe – not a race against each other, but toward their own climate targets

Figure 2. Electric vehicle shares of new light-duty vehicle sales for the largest vehicle markets from 2011 to 2021(Source: ICCT: https://theicct.org/publication/global-ev-update-2021-jun22/) Note: In this Figure, the European market does not include the United Kingdom

Different targets

Both regions set their carbon neutrality targets – Europe by 2050 and China by 2060 – in different ways. China’s pledges were made by its president at a United Nations conference (General Assembly), while Europe wrote into law the 2050 goal set by the European Green Deal. This is called the European Climate Law and it additionally requires the transportation sector to reduce its carbon footprint by 90 per cent by mid-century compared with the 1990 baseline. The sector-specific target drives various transportation policy actions in the Fit for 55 package. China has not yet set any binding climate targets for transportation, but did announce that it would peak transportation oil consumption by 2030 in its national action plan for peaking economy-wide carbon emissions.

The two regions have also used different regulatory approaches for driving zero-emission transportation. In Europe, vehicle CO2 standards play a pivotal role. Triggered by the Fit for 55 package, the European Commission proposed a fleet-wide CO2 emissions target of zero for all new cars and this will essentially phase out internal combustion vehicles by 2035. The Commission is currently working on a revised CO2 regulation for heavy-duty vehicles that aims to accelerate adoption of zero-emission technologies.

China’s policies are rather piecemeal and short term. Its overall electrification target was set in the nation’s automotive industry development plan, which seeks to build a vigorous and competitive auto industry, and currently it is electric vehicles as 20 per cent of new sales by 2025. To meet this goal, China’s industrial ministry mandates that car manufacturers generate a certain amount of electric vehicle credits. Modelled after California’s landmark Zero Emission Vehicle Program, the credit requirements can translate into sales share targets after being divided by the per-vehicle credit based on the electric vehicle’s electric range and other technical features. Since the rule took effect in 2018, China has raised the credit requirement from the initial ten per cent to 18 per cent in 2023. These targets were set incrementally to align with the above near-term target and are reflective of where the industry, market and technology development are already trending.

Heavy commercial vehicles were excluded from China’s targets. The development of electric commercial vehicles was mainly driven by the nation’s anti-air-pollution campaigns. A three-year Blue-Sky Defense Plan, in place beginning in 2018 and led by the Chinese environmental ministry, required the most air-polluted regions and industries to use clean transportation. This helped transform China’s Hebei province, traditionally known for being home to many heavy industries and very poor air quality, into the leading electric heavy truck submarket in the nation. In 2021, the province sold 3,900 electric dump trucks and semi-tractor trucks, more than half of

the nation’s total (Figure 3). Highlighting this is not meant to neglect that China adopted fuel efficiency standards for cars and trucks, but those regulations have been too weak to have any significant impact on electrification.

Figure 3. Geographical distribution of electric dump trucks and semi-tractor trucks in China, 2021 (Source: ICCT)

A striking difference

Despite the variety of policies in China to drive electric vehicles, these policies are missing a critical link to the nation’s decarbonisation target. This is perhaps the most striking difference from Europe.

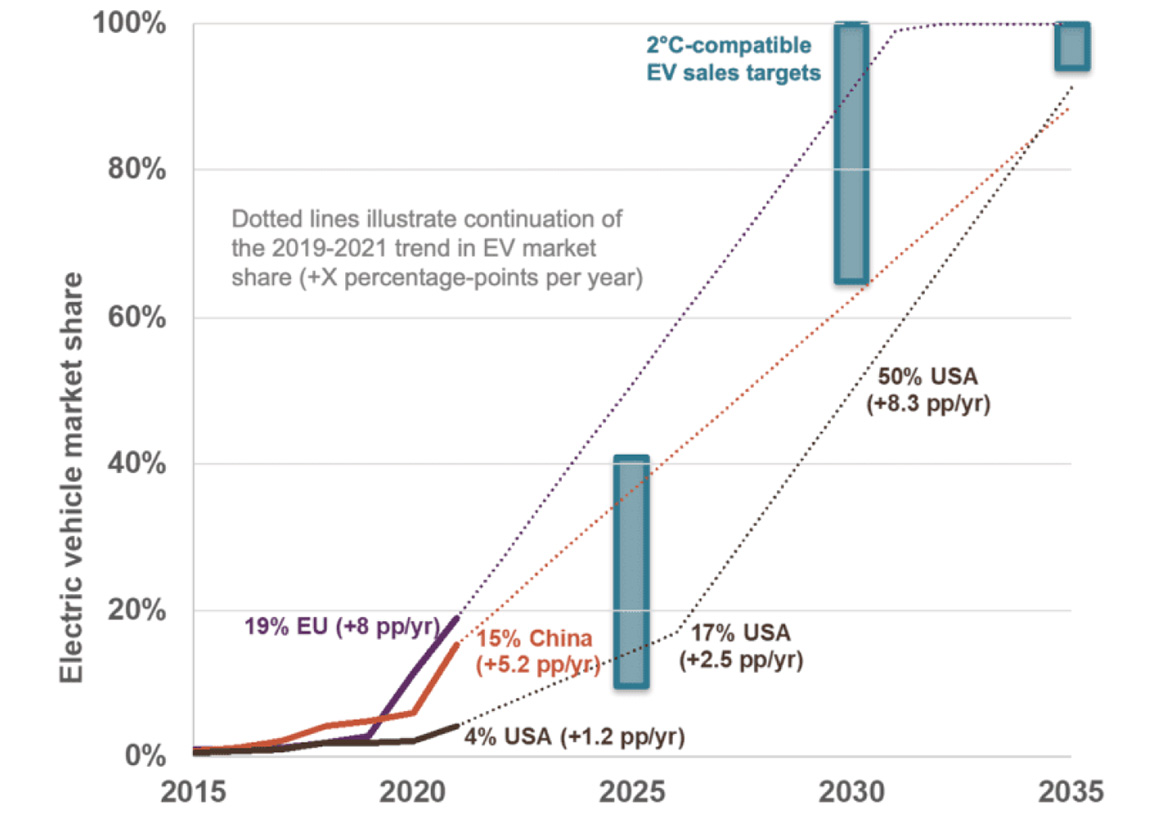

Because of the EU’s electric vehicle market development in the past three years, during which there was dramatic growth from three per cent of new sales in 2019 to 19 per cent in 2021, an increase of eight percentage points each year, the region can simply keep its current pace of electrification to meet the scenario that limits warming to 2°C.

China saw a similar increase wherein electric vehicles went from five per cent of new sales to 15 per cent during the same three years. To align with a 2°C-compatible pathway, though, China needs to raise its current annual electric vehicle sales growth from five to six percentage points per year (Figure 4).

Solid, enforceable policies will be the key to materialising these growth paths. In Europe, the proposed zero-CO2 emissions standard for cars holds a lot of promise, but the region still needs to develop interim or annual targets to ensure that manufacturers continuously work toward that long-term goal. The regulation also needs to take into consideration the real-world use pattern of plug-in hybrid vehicles so as not to over-credit this partial zero-emission technology. The EU is also considering revising its heavy-duty vehicle CO2 standard to further incentivise the production of electric trucks and buses.

China is going to further lift its passenger car electric vehicle credit target requirement to 38 per cent in 2025 and is also considering a similar credit policy for commercial vehicles. But, as said previously, these goals are industry-driven and too shortsighted. The nation can learn from Europe and develop enforceable CO2 standards for cars and trucks that are driven by broader industrial decarbonatisation goals.

Figure 4. Battery-electric and plug-in hybrid electric vehicle market share for new passenger vehicles in select markets from 2015 to 2021 compared with 2°C compatible electric vehicle sales targets. (Source: ICCT: https://theicct.org/eu-lvs-climate-path-jun22/) Note: The US data include light trucks, whereas EU and China are passenger cars only

Subscribe to Our Newsletter

Receive our monthly newsletter by email